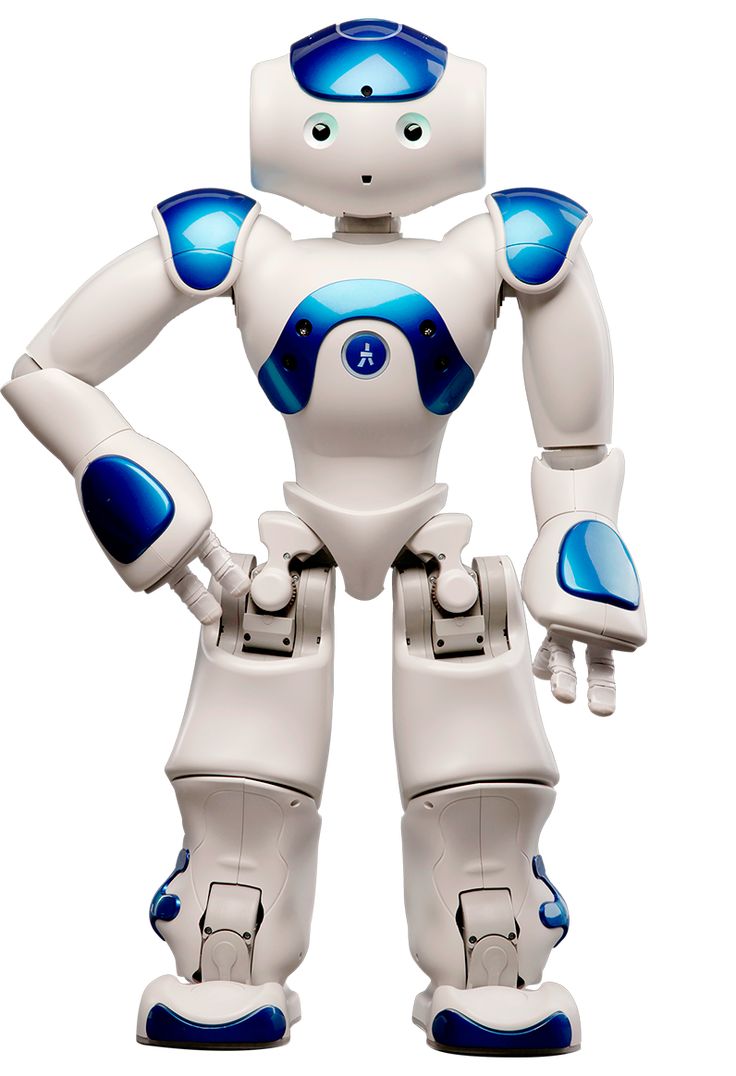

The global industrial robot industry is showing signs of recovery following a challenging period, according to a recent report by Interact Analysis. Despite facing headwinds in 2023, the sector has demonstrated resilience, with shipment volumes surpassing 500,000 units last year.

Market Overview

While shipment levels in 2023 were comparable to those seen in 2022, the average price of industrial robots experienced a decline. This follows a period of record highs in 2021 and subsequent lows in both revenues and shipments in 2023. Maya Xiao, research manager at Interact Analysis, notes that the average unit price of industrial robots is on a downward trajectory, with an expected annual decline of around 3% between 2024 and 2028.

The COVID-19 pandemic, coupled with high energy prices and inflation, led to an average price increase in 2022. Contrary to initial expectations of price decreases in 2023, ongoing supply chain issues and inflation kept prices close to 2022 levels. This "price effect" was partly attributed to the market trend towards heavy payload robots, which are inherently more expensive.

Despite these challenges, the long-term outlook remains optimistic. Interact Analysis projects the global industrial robot market to grow at an average annual rate of 3.7% between 2024 and 2028.

The industrial robot market is expected to grow by ~3.7% per year between 2024 and 2028. | Source: Interact Analysis

The industrial robot market is expected to grow by ~3.7% per year between 2024 and 2028. | Source: Interact Analysis

Regional Breakdown

The industrial robot market shows significant regional variations:

- Americas: The region faced considerable pressure in 2023, particularly in sales to the automotive industry. This resulted in slow growth for one of the largest downstream industries for industrial robots in the region. Mexico, heavily dependent on the automotive sector, felt a greater impact. Overall, growth in the Americas dropped by 17.3% in 2023.

- Asia-Pacific (APAC): This region saw a slight increase in growth.

- Europe, Middle East, and Africa (EMEA): Growth remained stable in this region.

In terms of market share, APAC dominated with 62% of global industrial robot revenues, followed by EMEA at 22% and the Americas at 17%.

Common Applications

The top three applications for industrial robots in 2023 were:

- Material handling (accounting for one-third of market revenues)

- Welding

- Assembly

These three applications collectively represented over 70% of industrial robot market revenues in 2023. Material handling is particularly prominent in the Americas and Europe.

North American Market Update

Recent data from the Association for Advancing Automation (A3) indicates that robot sales in North America continue to face challenges. In the first quarter of 2024, robot sales were down 6% compared to the same period in 2023. Companies purchased 8,582 robots from January through March, totaling $494 million.

The American market shows the highest concentration globally, with the top five suppliers accounting for nearly 80% of revenues and over two-thirds of unit shipments.

Underlying Factors

Xiao emphasizes that robotics forecasts are underpinned by the Interact Analysis Manufacturing Industry Output (MIO) Tracker. The growth profile for industrial robots reflects the manufacturing slowdown during the pandemic era and the subsequent downturn in 2023. Historic manufacturing contractions in China, Europe, and the Americas align with the observed decline in growth for the industrial robot market in recent years.

While the industrial robot market has faced significant challenges, particularly in 2023, signs of recovery are emerging. The industry's resilience, coupled with projected growth rates and ongoing technological advancements, suggests a cautiously optimistic outlook for the coming years. However, regional variations and economic factors will continue to play crucial roles in shaping the market's future trajectory.