A landmark merger poised to umbrella a top robot vacuum firm under e-commerce giant Amazon has collapsed amid mounting scrutiny. After nearly 18 months pursuing regulatory approval for Amazon’s $1.7 billion purchase of iRobot, both companies agreed this week to terminate the deal.

Executives cited “undue and disproportionate” regulatory resistance as the breaking point sinking the acquisition. Amazon specifically alleged the Federal Trade Commission and European Commission denied consumers faster innovation and competitive pricing by blocking consolidation.

But critics of mega-mergers counter that preserving competition itself spurs innovation long-term. And the demise still leaves iRobot confronting sales slumps and segment challengers. Its co-founder CEO Colin Angle has now stepped down, with interim chief Glen Weinstein tapped to lead a corporate restructuring.

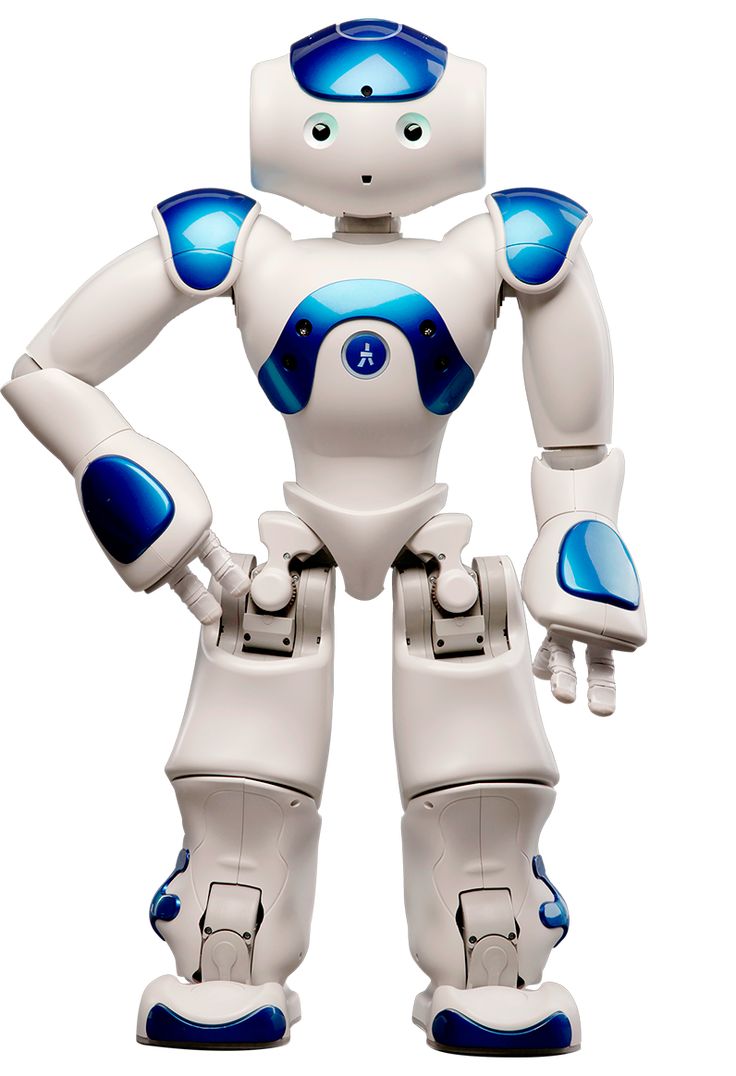

The deal’s August 2022 announcement initially seemed propitious for shareholders on both sides. Pairing iRobot’s popular Roomba autonomous vacuum line with Amazon’s distribution muscle looked to accelerate smart home proliferation. And the $61 per share price tagged a premium for iRobot weighed down by recent earnings misses.

But U.S. and E.U. antitrust authorities quickly launched investigations focused on data privacy risks and market domination. Amazon’s existing slate of Alexa-powered appliances and devices raised conflict questions given iRobot’s plans to expand in-home mapping. Scrutiny only intensified amid 2022’s M&A surge.

Though some jurisdictional clearances proceeded, signs of trouble emerged as the FTC kept probing and iRobot started cost-cutting — even laying off 10% of staff. By late 2023 the E.U. Deal regulators bluntly warned they would likely challenge the buyout. The presumptive rejection finally triggered this week’s mutual decision to walk away.

Now independent again, iRobot aims to realign itself for profitability after a 25% annual revenue drop. Mass layoffs, product roadmap trimming and supply chain renegotiation intend to cut over $100 million in costs. Management sees focusing sales on core floor cleaning devices as the path to sustainability.

Yet the company still faces the same secular industry trends that potentially spurred it to sell in the first place. Most notably, SharkNinja and other brands keep chipping away share in robot vacuums once dominated by Roomba. And promising areas like robotic lawn care now look off limits with more constrained resources.

Navigating the next chapter following a momentous acquisition collapse won’t be straightforward. But by specializing rather than diversifying, management hopes returning iRobot to its innovative roots in practical home robots can write a comeback story. It just may need to keep watching competitors continue consolidating scale and reach around it.