The robotics industry kicked off 2024 with a steady stream of investments, totaling $578 million across 46 funding rounds in January. While this figure is substantially lower than the trailing twelve-month average, it aligns closely with January 2023's investment figure of $523 million, suggesting a consistent appetite for robotics technologies despite economic fluctuations.

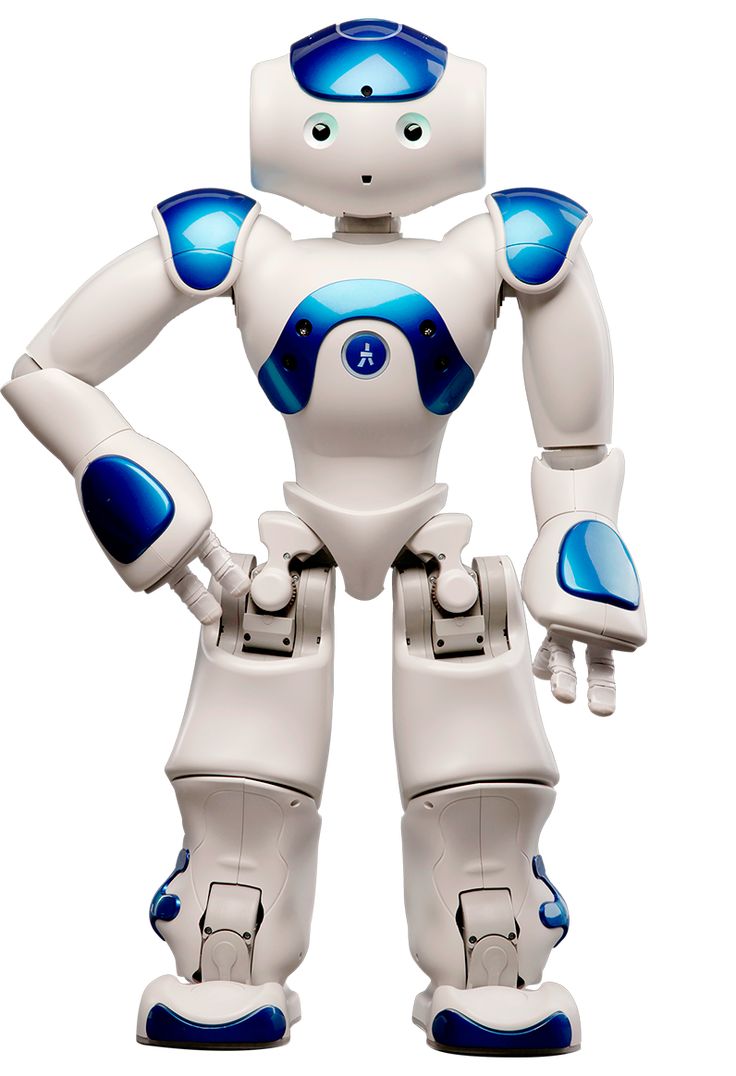

Leading the way in January's robotics investments was Norway-based 1X, a developer of humanoid robots, which secured an impressive $100 million funding round. The substantial investment in 1X underscores the growing interest and potential seen in humanoid robotics, a field that has long captured the imagination of researchers and investors alike.

Another notable investment in the humanoid robotics space came from Chinese developer Robot Era, which raised $14 million in February, further fueling the momentum in this burgeoning sector.

However, it was the makers of autonomous mobile robots (AMRs) for agricultural operations that stole the spotlight in February's robotics investments. Bluewhite, a prominent name in the field, secured a $39 million investment, while Burro raised $24 million, and Saga Robotics garnered $11.5 million. Additionally, farm-ng and Ant Robotics received $10 million and $2 million, respectively, reflecting the industry's recognition of the transformative potential of robotics in agriculture.

As the robotics industry continues to evolve and expand, quantifying investments in a consistent and reliable manner has become increasingly crucial. To this end, a rigorous definition of what constitutes a "robotics investment" is essential, ensuring that analyses are repeatable, valuable, and free from subjectivity.

In this context, investments are considered valid only when they come from venture capital firms, corporate investment groups, angel investors, and other similar sources. Friends-and-family investments, government grants, and crowd-sourced funding are excluded from the analysis.

Furthermore, for a company to be considered a "robotics company," it must generate or expect to generate revenue from the production of robotics products (devices that sense, analyze, and act in the physical world), hardware or software subsystems and enabling technologies for robots, or services supporting robotics devices. Autonomous vehicles, including technologies that support autonomous driving, and drones are included in this definition, while 3D printers, CNC systems, and various types of "hard" automation are excluded.

Companies that use the term "robot" solely for marketing purposes, without enabling or supporting devices acting in the physical world, are also excluded from the analysis. This includes "software robots" and robotic process automation.

Verification of funding information is a critical aspect of the analysis process. Data is collected from a wide range of public and private sources, including press releases, corporate briefings, market research firms, industry publications, conferences, seminars, and interviews with industry representatives and investors. Unverifiable investments are excluded, and estimates are made where investment amounts are unclear or not provided.

As the robotics industry continues to gain momentum, driven by technological advancements and increasing demand across various sectors, the need for reliable and consistent investment analyses becomes paramount. By adhering to rigorous definitions and verification processes, industry stakeholders can gain valuable insights into the state of the robotics market, enabling them to make informed decisions and capitalize on emerging opportunities.

Hundreds of people have already seen a promising direction in the robots and are moving with the times. And you?