Robots have long tantalized retailers with visions of effortless inventory tracking, seamless restocking, and frictionless shopping experiences. Yet over a decade since emerging on the retail scene, robots remain fringe rather than mainstream. Despite incremental advances, thorny technical and business challenges continue plaguing wider adoption.

Recent developments showcase both persistent growing pains and glimmers of progress for retail robots. Several high-profile providers expanded their footprint amid upbeat funding news. Simbe Robotics, for instance, secured $28 million in fresh capital from robotics specialist Eclipse, on the back of multiple grocery deployments. Rival Badger Technologies is replacing earlier robots with new multi-purpose models in several chains. Behind the scenes, Brain Corp added imaging capabilities to its floor-cleaning robots for expanded data collection. Promising pilots are also popping up globally.

Yet setbacks persist, most notably Walmart canceling Bossa Nova’s robots across hundreds of stores. Zebra Technologies also aborted its efforts despite acquiring robotics standout Fetch. Evidently, elusive return-on-investment and unmet performance thresholds still hinder uptake.

Handheld devices like smartphones alternatively enable lower-cost digitization, although apps struggledifferentiating themselves in a fragmented market. Still more disruptive may be emerging “hybrid” solutions like Spacee, which puts cameras on movable tracks for flexible coverage without robots’ limitations.

Four key challenges explain retail robots’ halting progress. First, autonomous navigation remains buggy. Robots still struggle maneuvering congested, unpredictable aisles without mishaps. Second, computer vision and data quality issues dog inventory management use cases. Achieving accurate, consistent datasetswas Walmart’s undoing with Bossa Nova. Third, costs stay high while benefits remain unclear. Proving game-changing ROI was Zebra’s reported Waterloo. Finally, technical complexity slows development. Robust, reliable systems don’t emerge overnight.

Yet the news isn’t all bad. Pockets of regional success demonstrate select use cases gaining traction, typically inventory management. We’re also seeing consolidation around fewer players with sharpened business models, like Badger’s pivot to multi-function robots. Smarter software, falling sensor prices, and cloud services will likewise lower barriers to entry over time.

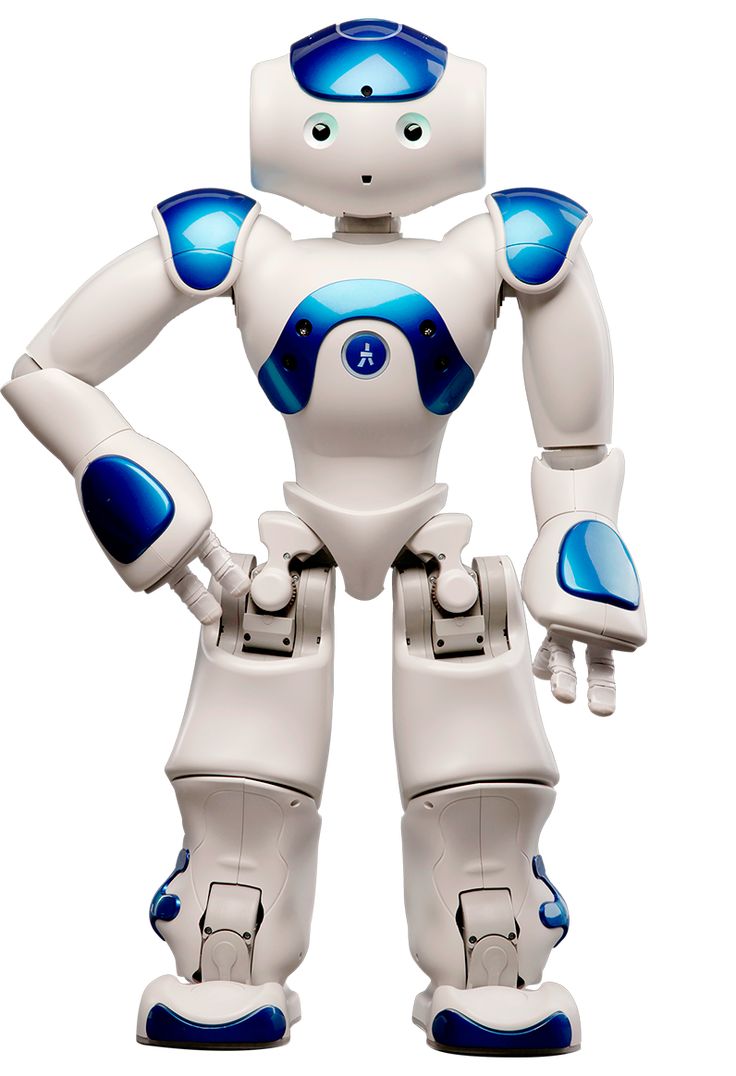

Crucially, next-generation robot capabilities could prove transformational where earlier models underwhelmed. Already firms like Vici Robotics are developing robots that not only scan shelves but also restock them via robotic arms. This could slash labor costs while solving pain points around out-of-stocks. We may ultimately see such multipurpose robots become retail workhorses – cleaning floors, tracking inventory, filling shelves, and hauling freight.

Key enablers will be enhanced safety, flexibility, and intelligence allowing more dynamic autonomous actions. These could make robots indispensable retail assistants, especially for tedious logistical tasks. Robots may finally escape pilot purgatory to see scaled adoption once they evolve beyond fragmented single-use cases.

The upshot is existing technical limitations and business challenges shouldn’t obscure robotics’ still-tantalizing long-term potential. Today’s modest deployments remain just the opening act before ubiquitous adoption later this decade. Smarter, more versatile robots will cement themselves as retail’s hardworking unsung heroes – even if today they still face sporadic snags on the road to viability. For now, the revolution remains uneven, but determined innovators continue marching robots toward an increasingly exciting retail future.