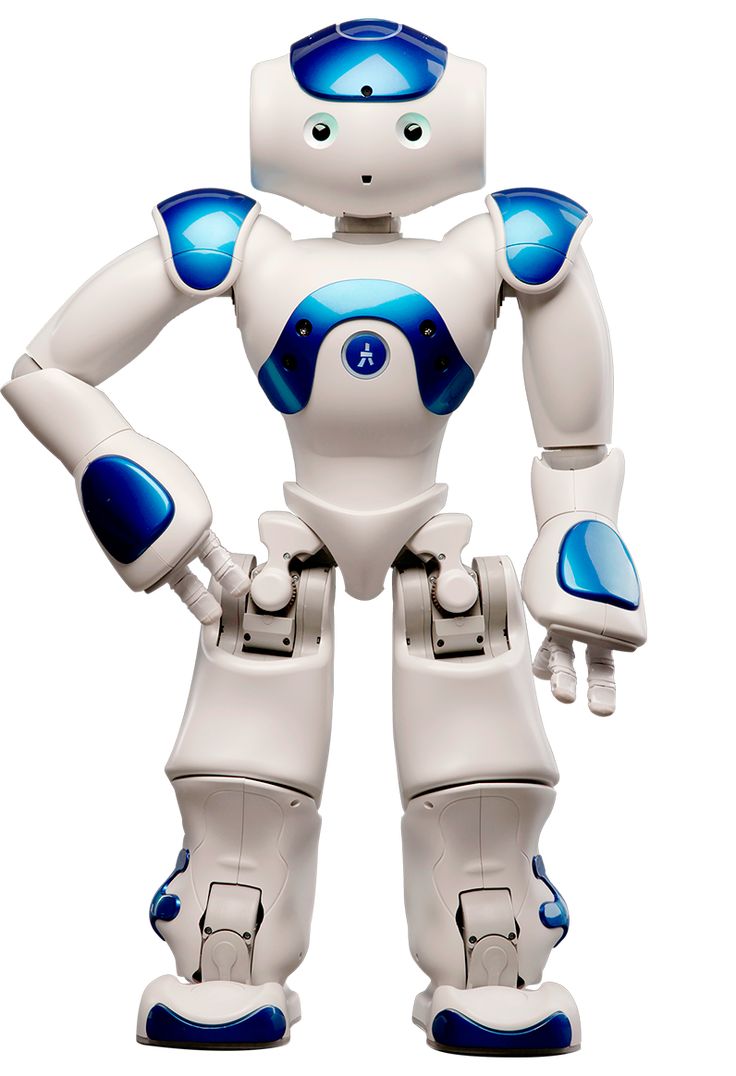

As the use of robots in various industries continues to grow, so does the need for proper insurance coverage. Robots can now become a new insurance target, with robot insurance policies designed to protect property and address cyber risks.

For instance, a robot dog can be insured as the property of individuals or legal entities. When purchasing a robot, the seller can offer a robot insurance policy alongside the product, covering classical property risks, warranty period risks, or post-warranty risks.

Individuals can benefit from a robot insurance policy that covers classical property risks, as the prices for such goods can be quite substantial. In the event of damage or breakdown, a payout from the insurance company can help offset the costs.

Moreover, robot insurance can also cover the risk of losses for robot owners resulting from unauthorized introduction of malicious computer programs (viruses) into the control computer, which may provoke aggressive behavior and cause damage to property or the health of others. Insurance contracts can include compensation for damage caused to the property and health of third parties, such as when a robot dog falls under the wheels of a passing car, motorcycle, or bicycle.

Hire robot workers with confidence, knowing that you can protect your investment with robot insurance. This innovative insurance solution ensures that your property and potential cyber risks are covered, providing peace of mind as you integrate robots into your personal or professional life.