Once a niche technology, collaborative robots or "cobots" are quickly moving into the mainstream manufacturing world. According to a new analysis by tech market advisory firm ABI Research, the yearly revenue for cobot arms is projected to soar from just $711 million in 2019 to $11.8 billion by 2030.

Even more staggering, when accounting for software, services, and end-of-arm tooling, the total collaborative robotics market could be worth $24 billion in just seven years - up from around $1 billion today.

"The prospects for collaborative robotics remain incredibly strong despite some inhibitors," said Rian Whitton, Senior Analyst at ABI Research. "While the innovation on the hardware side has lagged, the true value comes from ease-of-use, re-programmability, lower costs, and re-deployability compared to traditional industrial robot systems."

Breaking Down Barriers to Automation

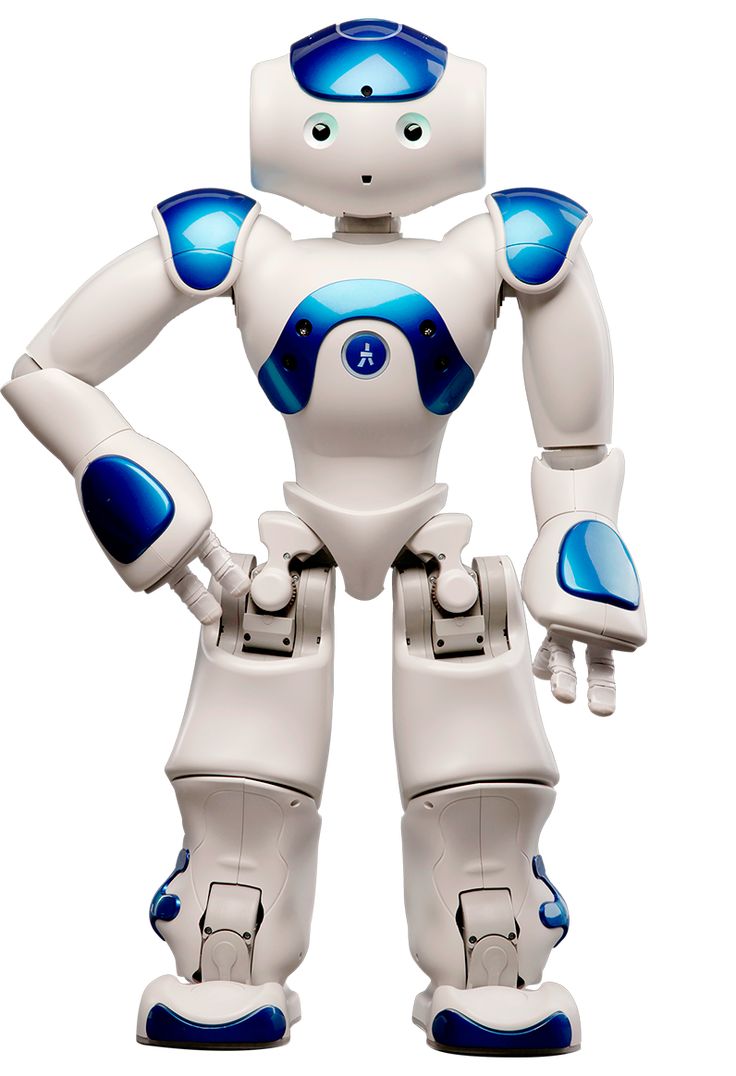

Unlike industrial robots designed for specialized, high-volume production, cobots excel at lower-volume, higher-mix tasks. Their inherent flexibility allows manufacturers, especially small-to-medium enterprises, to automate processes that were previously too complex or low-scale.

As manufacturing demands continue shifting toward customization, last-minute orders, and high-mix, low-volume model, collaborative robots provide the lean, adaptable solution companies desperately need.

"Cobots aren't revolutionizing manufacturing so much as catalyzing a transition to leaner, more flexible automation suited for today's market realities," said Whitton.

While trailing industrial robots in speed and payload for now, advances in sensors, machine vision, and motion control are allowing cobots to rapidly close the performance gap. By 2030, cobot arms could account for 29% of total industrial robot revenue as the two technologies converge.

Leaders Driving Early Adoption

Currently, just a handful of pioneering companies are fueling collaborative robotics' growth trajectory. Denmark's Universal Robots dominated the market in 2018 with 59% global cobot shipments.

The company has achieved relevance across major auto industry players like automakers and suppliers leveraging cobots for screw-driving, pick-and-place, and machine tending tasks.Manufacturing giant Jabil has deployed Universal's cobots en masse, citing their effectiveness as re-deployable, flexible assets.

As more industrial firms embrace high-mix, rapid-changeover production models, solutions enabling that transition will be in high demand. While not a panacea, collaborative robots represent an important stepping stone.

Their key advantages - lowering barriers through intuitive programming, reduced costs, and redeployability between tasks - align perfectly with manufacturing's evolving needs. With advances continuing to close the performance gap, the cobot revolution shows no signs of slowing over the next decade.