In a dramatic strategic shift after years of challenges developing its robotic surgical platform, Titan Medical has announced plans to merge with cardiovascular imaging company Conavi Medical in an all-stock deal valuing the combined entity at nearly $75 million.

The unexpected merger agreement comes on the heels of Titan effectively winding down its ambitious but troubled efforts to commercialize a robotic-assisted surgery system to rival market leaders like Intuitive Surgical. After suspending development of its ENOS robotic platform in early 2023 amid financial struggles, Titan began a wide-ranging strategic review that included exploring a potential sale of the entire company.

Ultimately, Titan determined that merging with another surgical robotics firm "was not a viable option," according to interim CEO and board chair Paul Cataford. Instead, the company expanded its search and struck a deal to combine with Conavi, a commercial-stage business focused on advanced imaging systems to guide minimally invasive coronary procedures.

"Conavi is an exciting commercial-stage company with groundbreaking technology and an accomplished management team," Cataford said in announcing the merger. "We are confident in their ability to continue to drive adoption of the Novasight Hybrid system."

That system, which has FDA clearance and approvals in multiple other markets, combines intravascular ultrasound (IVUS) and optical coherence tomography (OCT) imaging modalities to provide physicians with simultaneous and co-registered imaging of coronary arteries during stent placements and other interventional cardiovascular procedures.

By fusing the two complementary imaging streams into a single intuitive platform, Conavi aims to give physicians more comprehensive insights to aid in diagnosis and treatment while also providing a more cost-effective and streamlined imaging solution compared to deploying separate IVUS and OCT systems.

For Conavi, the merger with the publicly traded Titan provides a path to raise substantial new funding through the public markets to accelerate commercialization of its hybrid imaging technology. As a condition of the deal's closing, Conavi plans to complete a $15 million to $20 million equity financing round.

"Gaining access to the public capital markets will enhance our financial strength and fuel our growth strategy, enabling us to unlock the full potential of our hybrid imaging technology in the United States and globally," said Conavi CEO Thomas Looby.

Conavi's leadership team, including Looby, will assume operational control of the combined company, which is expected to eventually rename itself Conavi Medical following the closing of the merger targeted for around July 2024. Titan also plans to list its shares on the more junior TSX Venture Exchange rather than the mainline Toronto Stock Exchange.

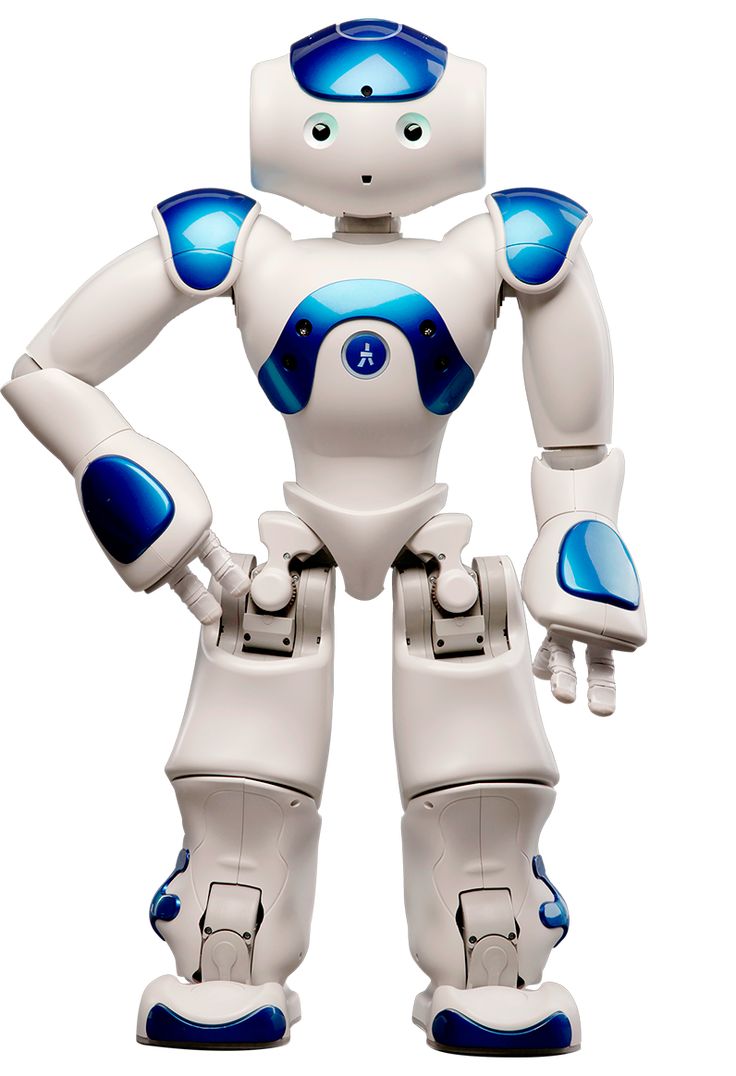

The agreement caps a turbulent period for Titan ever since the company terminated a promising multi-year partnership with global medtech giant Medtronic back in 2021 to take its surgical robotics platform in-house. The company had raised over $130 million by mid-2022 to develop its ENOS robotic-assisted surgical system, which utilized multi-articulating instruments and augmented reality imaging aimed at eventually rivaling systems like Intuitive's wildly popular da Vinci robot.

But with just $24 million in cash remaining as of November 2022, Titan abruptly announced it was suspending a planned shareholder vote on a share consolidation plan and launching a strategic review evaluating all options from selling assets to exploring potential merger and acquisition opportunities.

Over the following months, Titan proceeded to slash its workforce, winding down ENOS development and pivoting to monetizing its robotic surgery intellectual property. This included agreements to license its surgical robotics patents and technology to companies like Intuitive Surgical and others.

For Titan and its shareholders, the Conavi merger represents a new lease on life after the implosion of its ambitious robotic surgery aspirations. While unquestionably a letdown for the company's long-running efforts in that field, the deal re-establishes Titan in the minimally invasive medtech space via Conavi's promising hybrid imaging solution.

Whether the combination and fresh funding can propel Conavi's technology to the forefront of interventional cardiology imaging—and recoup value for Titan investors after its costly foray into robotic surgery—remains to be seen. But for a company that seemed at risk of running out of road just months ago, the merger at least charts a new path forward, even if it's in an entirely new direction.